Overview of Mexico

Mexico is one of the largest economies in South America and also the world's largest Spanish speaking country. It covers an area of 1.916 million square kilometers and is divided into 32 states in terms of administrative divisions. The gross domestic product in 2020 was 1.04 trillion US dollars. In 2021, the population was 126 million, making it the tenth most populous country in the world, with Indo European mixed race and Native Americans accounting for over 90% of Mexico's total population. 88% of residents believe in Catholicism, and 5.2% believe in Protestantism. The official language is Spanish, and the first foreign language is English.

Mexico is a free market economy with economic strength ranking fourth in the Americas and thirteenth in the world. After the establishment of the North American Free Trade Area in 1994, it greatly promoted economic development and increased national income. The development of its industry and power industry has a significant impact on the global market, especially on the entire North and South American markets, and power transformers are an indispensable part. The power transformer market in Mexico has a large scale and good growth prospects, but there are also some challenges.

1、 The size and growth prospects of the Mexican power transformer market

According to market research company data, the transformer market size in Mexico is approximately $6 billion and is expected to reach $7.5 billion by 2025. The Mexican government is strengthening infrastructure construction, which will drive the development of the transformer market. At the same time, with the acceleration of urbanization, the demand for electricity is also constantly increasing, which provides greater development space for the power transformer market.

At the same time, the power transformer products produced in Mexico are mainly exported to the United States, Canada, and surrounding American countries (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Chile, Brazil, Peru, etc.). Among them, the power transformer market sold by Mexico to the United States is relatively large. According to market research company data, the export value of Mexican transformer products in 2019 was about 1.43 billion US dollars, Among them, transformer products exported to the United States account for a considerable proportion. It is expected that by 2025, the export value of Mexican power transformer products will reach 2.3 billion US dollars.

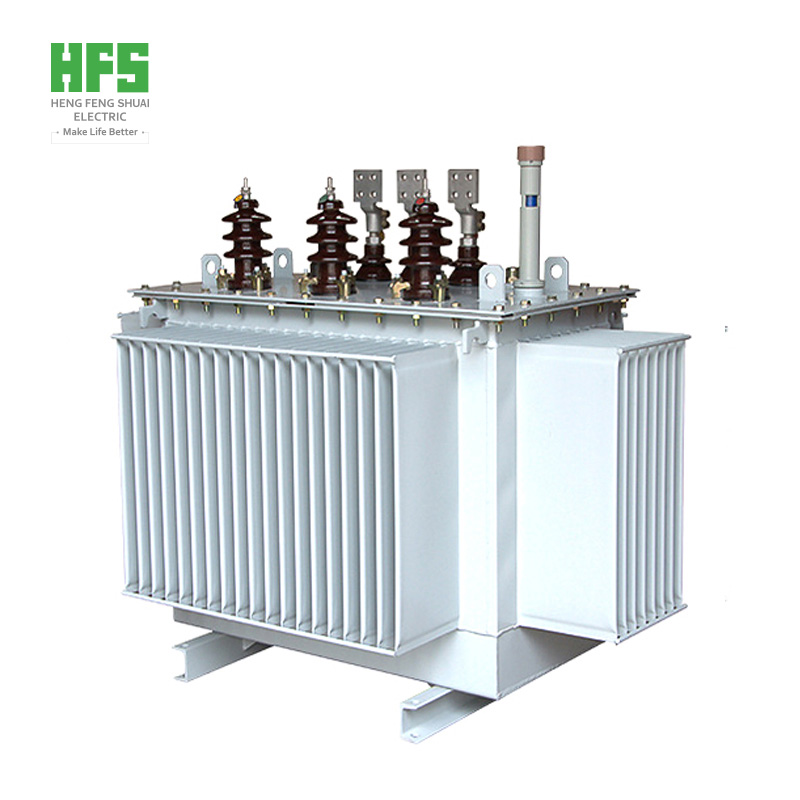

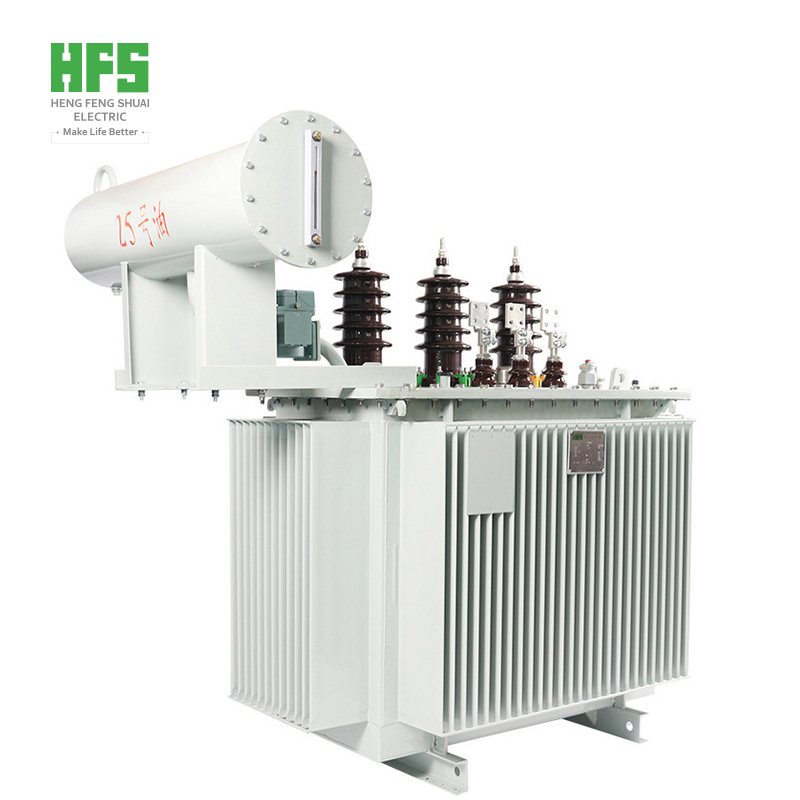

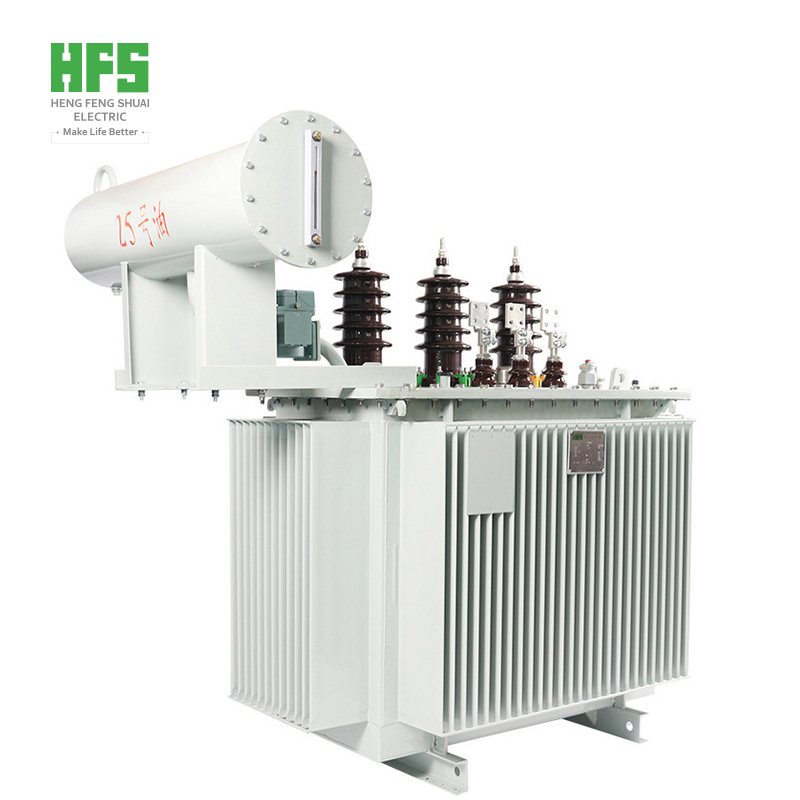

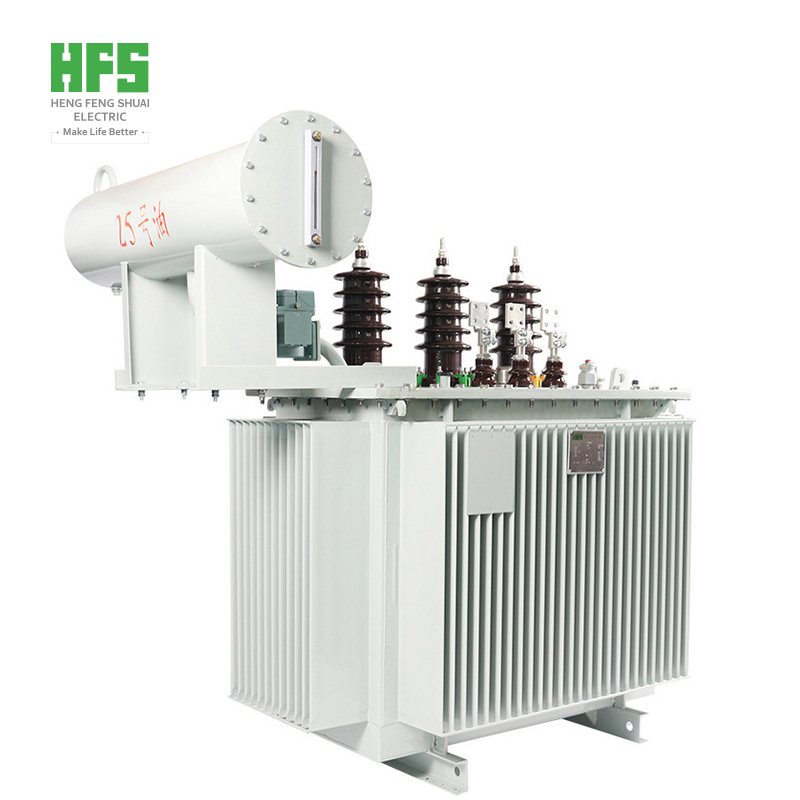

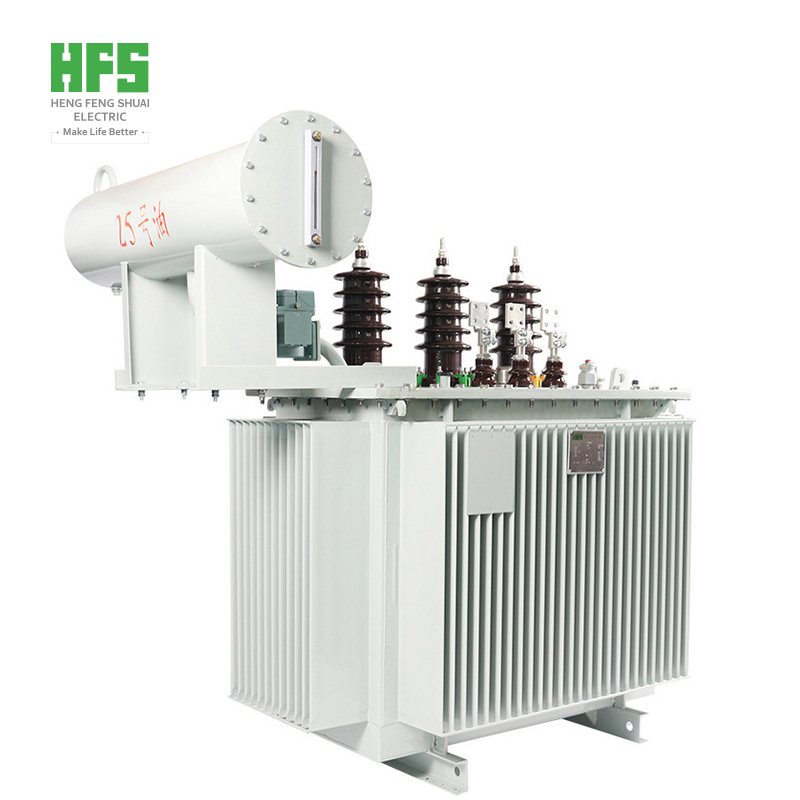

Due to the underdeveloped industry in Mexico, the production capacity of domestic power transformers is facing a shortage. Therefore, it is necessary to import some power transformers from Chinese manufacturers such as Hengfengshuai Electric to meet the demand. According to Olivia, the sales manager of Hengfengshuai Electric, the main power transformers exported to Mexico are column mounted single-phase transformers, pad mounted transformers, and grid main transformers, The energy efficiency requirements for transformers are high, and the demand for amorphous transformers is increasing, indicating an increasing demand in the market for low loss and high energy efficiency

2、 The competitive landscape of the Mexican power transformer market

The Mexican power transformer market is highly competitive, with major players including internationally renowned brands such as ABB, Schneider Electric, and Schunk; Chinese manufacturers such as Guangdong Igor and Qingdao Hengfengshuai Electric, as well as local power transformer companies in Mexico. These enterprises are constantly strengthening technological innovation and product upgrades to improve product quality and reduce costs. At the same time, these enterprises are actively exploring international markets to expand their market share.

3、 Challenges and Opportunities in the Mexican Power Transformer Market

The Mexican transformer market is facing some challenges, such as fluctuations in raw material prices and rising labor costs. However, the Mexican government is also taking a series of measures, such as strengthening support for local enterprises, improving industrial product standards, reducing taxes, etc., to attract more foreign investment and promote the development of local enterprises. These measures will help improve market competitiveness and increase market opportunities.

In summary, the transformer market in Mexico has broad development prospects and a favorable competitive environment. Enterprises should focus on technological innovation and product upgrading, actively explore international markets, in order to improve market competitiveness and increase market share.